A common question small business people have is whether they should buy or lease their vehicle. Let’s take a look at some of the Pro’s and Con’s of each.

Generally, leasing a car instead of buying only makes financial sense if you prefer a new car every 3 or 4 years and drive an average amount of miles each year.

If you drive more than 15,000 or 20,000 miles per year you will be penalized for the high mileage with a larger monthly payment or a penalty at end of the lease.

If you only drive 5,000 or 10,000 miles per year you will not be given credit for the low mileage on the car unless you choose to buy it at the end of the lease term.

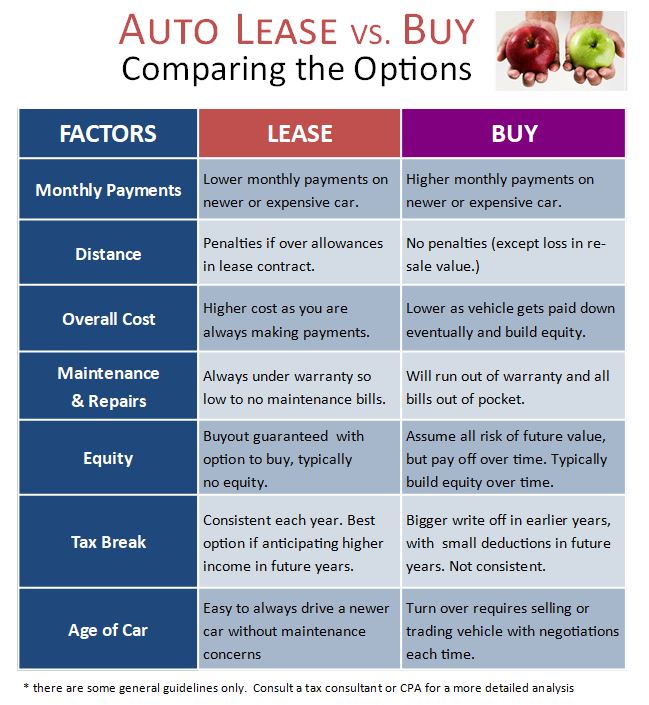

This chart will help highlight some factors:

Other Factors to Consider

Buying May be Better WHEN:

If you are looking to drive a vehicle for 5 to 10 years, then purchasing a vehicle may be the better option. It saves you the trouble and fees involved in buying out the vehicle at the end of the lease term. It also is more likely you will pay the vehicle off sooner than having to pay a lease for 3 or 4 years and then financing the lease buyout for another 3 or 4 years.

If you prefer a less complicated transaction without all the terms and conditions you may prefer a purchase. No concerns about restrictions and requirements of the leasing company regarding use, or condition of the vehicle at dropoff, or mileage penalties, or early termination restrictions.

If you prefer to buy a “used” vehicle then you will prefer to purchase. You can save considerable money on the “purchase” when buying a 2 or 3-year-old vehicle. .

Leasing May be Better WHEN:

- You do not want to use up your line of credit for a vehicle purchase.

- You want to invest in your business rather than investing in a vehicle purchase.

- You want to drive a newer or more expensive car but not have the large payments.

- You prefer a tax deduction that is consistent year after year.

For an online Lease versus Buy calculator click here

Hey, Thank you for taking the time to write this. I have to start blogging again soon ugh.

Thanks for your comment. Yes, finding time to blog can be a challange.. all the best with it!

I was able to find good info from your blog articles.

Thanks for you feedback, glad the articles are helpful for you!

I used to be able to find good info from your content.

There is definately a lot to know about this issue. I really like all the points you made.

Everything is very open with a precise explanation of the issues. It was really informative. Your site is useful. Many thanks for sharing!

Thanks for commenting!