From time to time a real estate agent may travel away from home to attend a conference, seminar, or conduct other business related activities. On these business trips, you may be able to deduct lodging, meals, transportation, and other related business expenses.

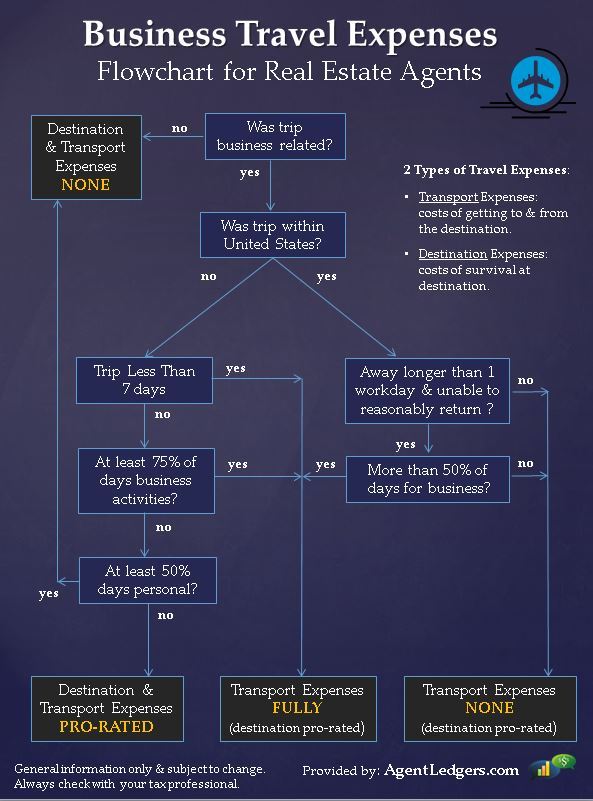

It is important to understand that there are 2 types of travel expenses:

- Transportation Expenses: which are the costs of getting you to and from your destination.

- Destination Expenses: which are costs of surviving at your destination.

So how and when do you deduct travel expenses?

This chart may help understand the IRS guidelines:

What Travel Expenses Are Deductible?

These travel expenses while away from home include, but aren’t limited to, the costs of:

- Travel by airplane, train, bus or car between your home and your business destination. (If you’re provided with a ticket or you’re riding free as a result of points or similar program, the cost is zero.)

- Fares for taxis

- Shipping of baggage

- Using your car while at your business destination.

- Car rental, you can deduct only the business-use portion of the expenses.

- Meals / Lodging /Dry Cleaning / Laundry.

- Business calls & communications

- Tips you pay for services related to any of these expenses.

- 50% of entertainment expenses for business purposes. You can’t deduct for activities that you attend alone, you must go with a business associate.

- Other similar ordinary and necessary expenses related to your business travel. (These expenses might include transportation to and from a business meal, computer rental fees).

Other Tips on Travel Deductions:

- Instead of keeping records of your meal expenses and deducting the actual cost, you can generally use a standard meal allowance, which varies depending on where you travel. The deduction for business meals is generally limited to 50% of the unreimbursed cost.

- You may NOT deduct lavish or extravagant expenses. Deductions must be ordinary and necessary and appropriate for your business.

- You can deduct as if you were traveling alone – no need to reduce deductions if others get a ‘free ride’.

Travel Inside the USA: (it is all or nothing)

If you spend more than 1/2 of your days in business activities at the destination you can deduct 100% of your transportation expenses and any destination expenses for the days you did business.

If you spend less than 1/2 your days doing business none of your transportation expenses will be deductible.

Travel Outside of the USA: (it depends)

If you travel outside the United States for seven days or LESS, you can deduct 100% of your airfare and transportation expenses and a pro-rated amount of all other destination expenses for only for the days you conducted business, as long as you spend part of the time on business.

If you travel outside the United States for MORE than seven days, you can deduct 100% of your transportation expenses, as long as you spend at least 75% of the time on business.

If you spend 51% to 75% of your time on business you can deduct a pro-rated amount. If you spend 50% or less of your time on business then you cannot deduct any of your transportation costs.

*for IRS Bulletin on Business Travel Deductions click here

Recent Comments